Recently, people have been heavily relying on AI for everyday tasks like research, writing, and coding. But when it comes to something as sensitive and financially significant as investing, things can get complicated. Putting your money into the stock market based solely on AI-generated advice might sound risky, and to be honest, it can be if you’re not using the right tools.

That said, when used wisely, AI can become a powerful assistant. With the right platform, you can analyze stocks faster, automate parts of your trading strategy, and even identify market trends, all without needing deep financial knowledge or spending hours buried in spreadsheets.

In this blog, we’ll cover the best free AI tools for the stock market. These tools can help you save time, reduce emotional bias, and make smarter decisions. Still, it’s important to remember: Use AI tools as a guide, not gospel. Always do your research and analysis before making any investment decisions.

Best AI Tools for the Stock Market

Here is a list of some of the best AI tools for the stock market. Each tool listed serves a different type of investor or trader and market. Here’s how to choose:

| Tool | Best For | Primary Focus | Markets Covered |

| Portal AI | Beginners, fundamental analysts | Stock analysis (India-specific) | India (NSE/BSE) |

| Zerodha Streak | Retail traders | Strategy automation, alerts | India (NSE/BSE only, requires Zerodha account) |

| Sensibull | Options traders | AI options strategies | India (NSE options only) |

| TradingView | Technical traders | AI indicators and charting | Global (US, EU, India, Crypto, Commodities) |

| Kavout | Long-term investors | Predictive scoring | Global (US-focused, limited Indian stocks) |

| Superalgos | Developers, quant traders | Full automation and custom bots | Global (Stocks, Crypto, Forex – needs setup) |

| MarketX | Swing traders | AI-based prediction and trends | India (NSE/BSE) |

| AlphaSense | Institutional analysts | AI financial document research | US, Europe, Global equities & private markets |

| Trade Ideas | Day traders, swing traders | Real-time AI stock scanning | US stocks only (NYSE, NASDAQ) |

| TipRanks | Long-term investors | AI stock scoring & analyst ratings | US, Canada, EU (limited Asian coverage) |

| QuantConnect | Quant traders, developers | Algorithmic trading with AI/ML | Global (US, EU, Asia, Crypto – supports 100+ brokers) |

Superalgos

Category: Open-Source AI Stock Trading Bot Platform

Best For: Advanced users and developers

Pricing: Completely free and open source

Markets Covered: Global (Stocks, Crypto, Forex – supports multiple brokers)

Features:

- Visual strategy design (drag and drop)

- Connects to crypto and stock exchanges

- Built-in data mining and backtesting

- Full bot automation supported

- Community-driven architecture

Analysis:

Superalgos is not for beginners but for users comfortable with data models, strategy design, and terminal setups. It offers powerful AI automation for free. Users can customize everything from signal processing to portfolio management. It supports multiple asset classes, not just equities.

If you’re building custom AI stock trading bots, Superalgos is one of the most powerful free platforms available, but it requires a learning curve.

Drawbacks:

- Steep learning curve

- Requires local setup and data configuration

- No out-of-the-box stock prediction or analysis

MarketX

Category: Predictive AI and Market Sentiment Tool

Best For: Traders looking for AI-based stock prediction in India

Pricing: Free basic version; premium version for full features

Markets Covered: India (NSE/BSE)

Features:

- Predictive analytics for short-term and long-term stock movements

- AI-based sentiment analysis

- Real-time data on price trends, news, and forecasts

- Designed for Indian stocks and indices

Analysis:

MarketX combines AI-driven forecasting with sentiment analysis. It’s designed to help investors anticipate stock movement by analyzing historical patterns, volume spikes, and market sentiment. This tool is useful for swing traders or investors looking to time entry/exit points.

It isn’t a full-featured trading platform or execution engine, but it fits well as a forecasting layer in your analysis stack.

Drawbacks:

- Limited functionality in free plan

- Forecast accuracy varies with volatility

- No strategy automation or backtesting

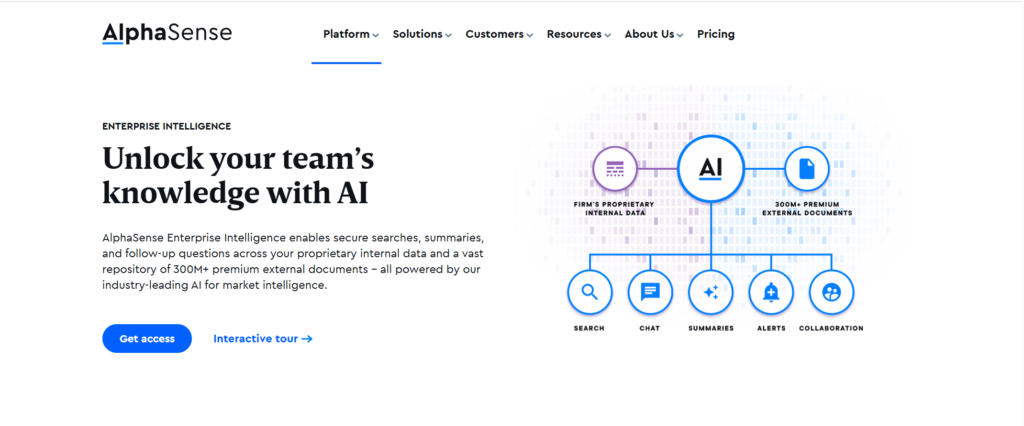

AlphaSense

Category: AI-Powered Market Intelligence & Research

Best For: Fundamental analysts, institutional investors, corporate teams

Pricing: Free trial available; paid plans for full access

Markets Covered: US, Europe, Global equities & private markets

Features:

- AI-powered search across earnings calls, SEC filings, and research reports

- Sentiment analysis and trend detection

- Coverage includes US and European equities, bonds, and private markets

Analysis:

AlphaSense is like a next-gen Bloomberg Terminal, using NLP to extract insights from massive volumes of financial text. It’s extremely effective for fast, in-depth research and macro/micro trend identification.

Drawbacks:

- Premium pricing not suited for individual investors

- It may be overwhelming for beginners

- Mostly designed for institutional workflows

Trade Ideas

Category: AI Stock Scanner & Automated Trading

Best For: Day traders, swing traders

Pricing: Free trial available; paid plans start at $84/month

Markets Covered: US only (NYSE, NASDAQ)

Features:

- Holly AI suggests real-time trades based on historical and live market data

Built-in backtesting, simulated trading - Integration with brokers like Interactive Brokers and TD Ameritrade

Analysis:

Trade Ideas is one of the most advanced AI platforms for real-time stock scanning and trade suggestions. Holly AI constantly scans the market for high-probability trades, making it perfect for momentum or breakout strategies. It’s built for active traders, so if you’re a long-term investor, this may be overkill.

Drawbacks:

- High monthly cost for solo traders

- No support for long-term investment strategies

- Limited usefulness outside US markets

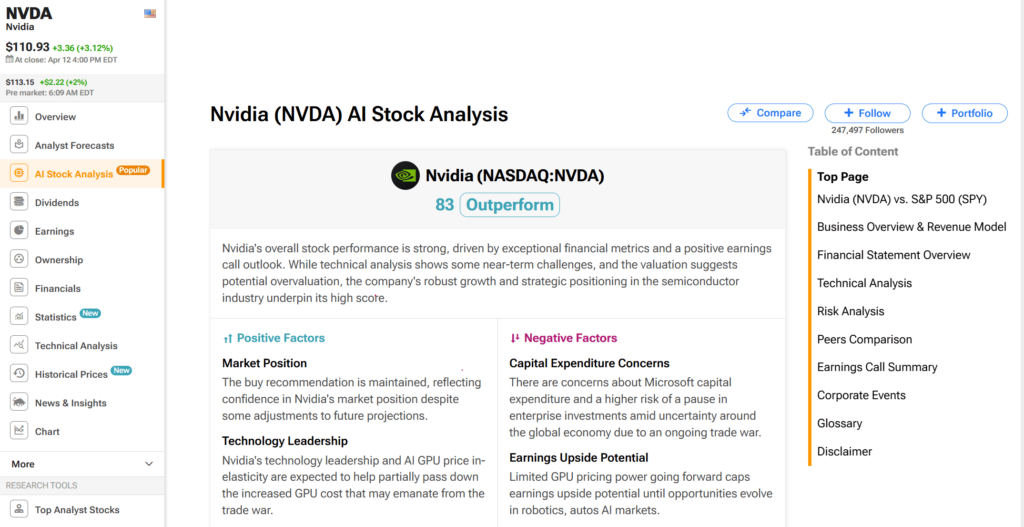

TipRanks

Category: AI Analyst Ratings & Stock Predictions

Best For: Long-term investors, dividend investors

Pricing: Free basic plan; premium starts at $29.95/month

Markets Covered: US, Canada, Europe (limited Asia)

Features:

- Aggregates analyst ratings and target prices

- AI-generated “Smart Score” based on multiple data points

- Tracks insider trades, hedge fund moves, and news sentiment

Analysis

TipRanks gives retail investors access to institutional-grade data. The Smart Score helps simplify decision-making by summarizing key metrics into a single, easy-to-read rating. It’s best for investors who want to evaluate stocks without diving deep into raw financials. However, it’s not suitable for active traders or algo strategies.

Drawbacks:

- Limited customization or filtering in free version

- AI scores may oversimplify complex stocks

- Primarily US-focused coverage

QuantConnect

Category: AI Algorithmic Trading Platform

Best For: Quant traders, developers, data scientists

Pricing: Free for backtesting; paid for live trading and premium features

Markets Covered: Global (US, EU, Asia, Crypto – 100+ broker integrations)

Features:

- Strategy building with Python/C#

- Integrates machine learning libraries

- Extensive market data across global equities

Portal AI by Trade Brains

Category: AI-Powered Stock Analysis

Best For: Retail investors looking for fast, AI-generated insights on Indian stocks

Pricing: Free credits available; pay-per-use model after that

Markets Covered: India (NSE/BSE)

Features:

- AI-generated fundamental stock reports using pre-built prompts

- Modules for balance sheet review, ratio analysis, quarterly performance

- Support for all Indian-listed companies

- Accessible via web and mobile (Trade Brains Portal app)

- No coding or financial background required

Analysis:

Portal AI stands out as the most India-focused free AI stock analysis tool. It eliminates the need to comb through annual reports or financial statements by turning your query into a detailed, prompt-based AI report. It does not support technical analysis or forecasting but excels at breaking down core fundamentals quickly and clearly. For investors looking to evaluate a stock’s health in minutes, it’s a reliable choice.

Drawbacks:

- No support for technical indicators or intraday data

- Doesn’t compare multiple stocks

- No predictive modeling

Zerodha Streak

Category: AI-Based Algorithmic Trading Platform

Best For: Traders who want to automate strategies without coding

Pricing: Free tier available with limited backtests; paid for advanced features

Markets Covered: India (NSE/BSE, requires Zerodha account)

Features:

- No-code strategy builder for entry/exit rules

- Backtesting across historical market data

- Deployment with Zerodha’s brokerage account

- Real-time alerts and notifications for strategy signals

- Mobile and web platform support

Analysis:

Zerodha Streak is one of the most widely adopted AI-based stock trading tools in India, particularly for Zerodha users. Its appeal lies in letting users create algorithmic strategies without knowing how to code. You simply define rules (e.g., Buy when RSI < 30) and the AI handles execution and analysis.

While it doesn’t offer full automation on free plans, the ability to test and iterate strategies is powerful. It’s ideal for technical traders looking to test momentum or trend-based approaches.

Drawbacks:

- Limited backtests in free version

- Requires a Zerodha account to deploy live

- Doesn’t cover fundamentals or prediction-based analytics

Sensibull

Category: AI-powered options Trading Platform

Best For: Options traders looking for AI-generated strategy suggestions

Pricing: Free tier available; paid for advanced tools

Markets Covered: India (NSE options only)

Features:

- AI-generated options trading strategies based on live data

- Risk-reward analysis and probability mapping

- Strategy comparison (e.g., spreads, iron condors)

- Market sentiment indicators

- Real-time alerts and position tracking

Analysis:

Sensibull is designed for options traders, especially those trading on NSE. It suggests trades like spreads or covered calls based on your risk profile. The AI component comes into play when recommending high-probability trades under current market conditions, using real-time data, implied volatility, and options greeks.

This is not for equity traders or long-term investors, it’s focused on active traders who deal with derivatives.

Drawbacks:

- Limited functionality on free plan

- Interface may be complex for beginners

- Only works with options, not equity stocks

TradingView (with AI Script Integration)

Category: Charting + Technical Analysis with AI Plugins

Best For: Traders using AI-based indicators and automation scripts

Pricing: Free plan with basic features; paid for premium indicators and alerts

Markets Covered: Global (US, EU, India, Crypto, Forex, Commodities)

Features:

- Supports Pine Script for custom AI indicators

- Community-built AI tools like auto-trendlines, sentiment analysis bots

- 100+ technical indicators, overlays, screeners

- Cross-device access, mobile/web/desktop

- Supports integration with brokers for order execution

Analysis:

While TradingView itself is not marketed as an AI tool, it supports AI-based stock trading in India via custom Pine Scripts and third-party integrations. Users can create or install predictive models, machine learning-based indicators or even connect AI bots for alerts. Its strength lies in flexibility and visualization.

It’s best suited for intermediate to advanced traders who want to customize strategies using technical data. The free plan provides enough for basic analysis, but full automation and alerts require upgrading.

Drawbacks:

- Not beginner-friendly

- Requires scripting or importing AI plugins

- Not specific to Indian equities unless manually filtered

Kavout

Category: AI Stock Prediction and Ranking

Best For: Long-term investors looking for stock scoring based on predictive analytics

Pricing: Free version available with limited features; premium plans available

Markets Covered: Global (US-focused, limited Indian stocks)

Features:

- Kai Score: An AI-driven stock ranking system

- Predictive analytics based on price trends, sentiment, and financials

- Portfolio optimization and monitoring tools

- Global stock coverage, including India

Analysis:

Kavout is ideal for investors who want to leverage AI-based scoring to select high-potential stocks. Its proprietary Kai Score ranks stocks by combining quantitative and qualitative factors. For Indian investors, it covers large and mid-cap companies, though it’s primarily designed for global markets.

This is not a trading bot or backtesting tool. It’s best used as a stock screening assistant based on forward-looking data models.

Drawbacks:

- Limited free access

- Not all Indian stocks are supported

- Less effective for active traders

Analysis:QuantConnect is a powerful platform for coders and quant traders building custom AI strategies. With support for machine learning and access to rich historical datasets, it’s ideal for testing predictive models and deploying bots. But it’s not beginner-friendly and requires programming knowledge to use effectively.

Drawbacks:

- Steep learning curve; requires coding

- No GUI for strategy building, code only

- Live trading access comes with added cost

Also Read: Best AI for Stock Analysis

Conclusion

AI is no longer a futuristic luxury, it’s a practical tool for every stock market participant today. Whether you want to run automated trades, perform free AI stock analysis, or access AI-based stock prediction, there’s a tool tailored for your needs.

Start simple with Portal AI or Streak if you’re new, and move toward advanced platforms like Superalgos or TradingView as you grow.

Make smart use of free plans, understand the tools’ limitations, and always backtest strategies before using them live. AI is a tool, your strategy still needs judgment.

FAQs

-

Is there any free AI tool for the stock market?

Yes, several AI tools offer free access or trial versions that can help with stock analysis, trading strategy building, and predictive insights. Tools like Portal AI, Zerodha Streak, and TradingView offer free plans or credits, allowing users to experience AI-driven stock market analysis without paying upfront.

-

Is there any AI for the stock market in India?

Absolutely. Platforms like Portal AI, Sensibull, and Zerodha Streak are specifically designed for the Indian stock market. They offer AI-powered insights, options strategy generation, and algorithmic trading support tailored for NSE and BSE-listed stocks.

-

Is there a free AI bot for trading?

Yes. Superalgos is an open-source AI trading bot platform that is completely free and supports full strategy automation. For users who prefer a no-code approach, Zerodha Streak offers a free tier where you can build and test strategies using AI-driven logic before deciding to go live